Online payment gateways are a modern solution for businesses to accept payments from customers safely and securely. Knowing how these systems work can help you make the right decisions for your business. First, let’s better understand credit card payment gateways and how they can be helpful to your business.

A credit card payment gateway is similar to a virtual cashier that automatically takes care of secure credit card transactions when customers buy your goods or services on the Internet. It serves as a kind of middleman between your website or app, the customer’s credit card issuer and your bank. The same applies for the instance where a customer enters their credit card (CC) data on your website: the payment gateway encrypts the data and transmits to the CC network for approval. After approval of the transaction, the payment gateway authorizes the payment and sends the funds to your bank account.

There are many reasons why you should consider applying with a credit card payment gateway. 1. It enables you to receive payments from customers globally, What this means is that you can now receive payments from people from any part of the world without limitation, and this will increase sales. And because payment gateways store customer data securely and for future use, it’s much easier for repeat purchasers to buy from you. Finally, payment gateways protect you and your customers by encrypting sensitive data and implementing security features that discourage, or at the very least make it difficult for unauthorized transactions to be made.

There are a few things that you should keep in mind when selecting the best credit card payment gateway for small business. First, consider the fees for the gateway such as fee per transaction and monthly subscription fee. Additionally, you need to check whether the gateway easily fits into your website or application’s UI and provides a convenient interface for customers. Finally, you will also want to weigh the security feature the gateway offers, such as the encryption level and fraud protection.

Businesses have a few different options when it comes to credit card payment gateways, each with its own strengths and weaknesses. Hosted payment gateways send your customers to a payment processing third party, which results in significantly increased security and compliance with its industry standards. Integrated payment gateways are more versatile, and can accept payment from customers without sending them out of your site. Mobile gateways are ideal for companies whose primary sales channel is through mobile apps and is designed to facilitate customer payment on-the-go.

Protecting your transactions with a credit card payment gateway is a must have to safeguard your business and its customers. Here are a few expert tips to help keep your transactions safe and secure. The first is to ensure that your payment gateway is up-to-par and compliant with industry security standards such as PCI DSS. Also, it is necessary to regularly upgrade your gateway software and encryption algorithms against new threats. Lastly, train both your employees and customers on proper online security measures, including how to create strong passwords and how to spot phishing attacks.

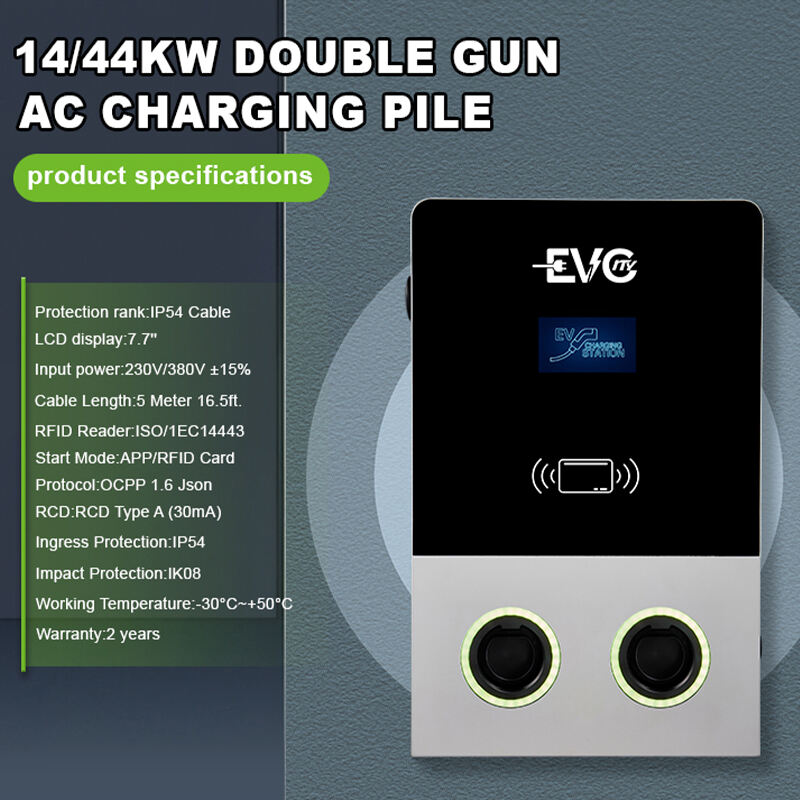

The machine combines functionality with credit card payment gateway. It is characterized by bright, concise lines and uses the galvanized sandblasting process and toughened glass. It is rated at IP54/IK08 and has a longevity of up to a decade and resistance to corrosion.

Equipped with credit card payment gateway, WiFi, 4G communication module, the charging output is compatible with single/three-phase or multi output (7KW/14KW/22KW/44KW). This significantly improves the charging efficiency while reducing the typical equipment and installation costs for labor.

credit card payment gateway a dual circuit breaker layout, it will prevent the device from overheating, reducing failures and hazards to safety and operate safely in harsh environments ranging from -40 to +70 degrees Celsius. The product had passed TUV certification.

It seamlessly integrates third-party operator's system. The credit card payment gateway (485) interfaces allow connection to the existing IOT systems.